Also dubbed “Silicon Forest,” Portland is a hotbed of tech companies, startups, and local entrepreneurs that create an attractive employment tapestry. Additionally, Portland’s renowned walkability, access to the outdoors and many other amenities make it an attractive place to move to. For the 2010 to 2020 decade, Portland registered a whopping 10.6% population growth, which rippled across all sectors of the economy, including construction.

Portland Featured Among the Most Active Real Estate Markets for Construction

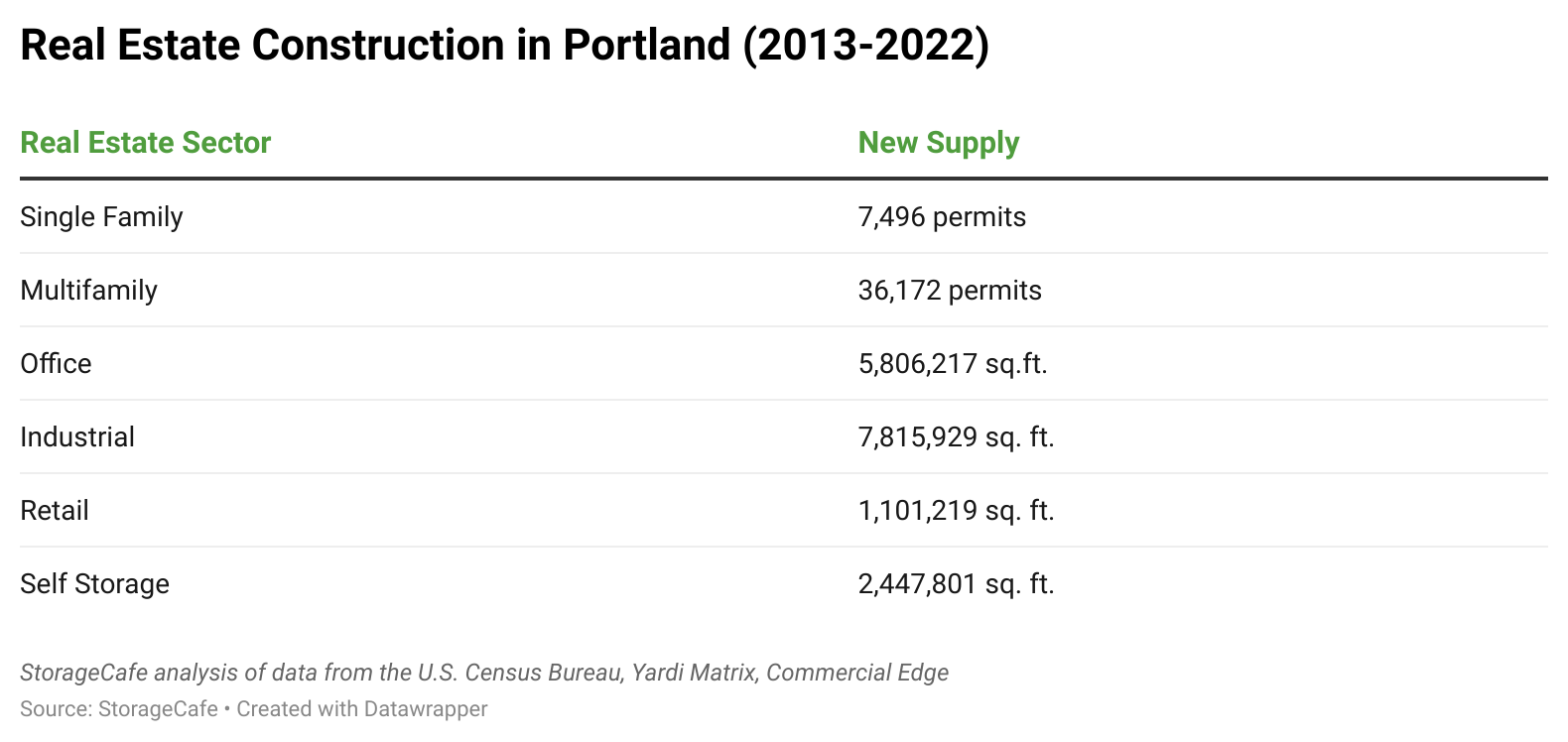

To gauge how well Portland performed against other cities nationally, StorageCafe put together a research report assessing real estate construction across all sectors, including residential (single-family and multifamily), self-storage, industrial, retail, and office in the top 100 largest cities by population for the 2013 to 2022 decade. As it turns out, Portland managed to rank among the top 30 cities for overall construction, with the apartment sector being the best performer.

Portland delivers over 30K apartments in a decade.

With the need for housing being constant across the U.S., Portland is no exception. As such, the city delivered over 36K apartments, based on permitting activity, in the span of the 2013 to 2022 decade.

The first half of the decade saw the bulk of the apartment construction in Portland, with 2017 marking the peak. The city issued over 6,500 permits for multifamily homes that year. Only 2018 came close to this construction level, with a little over 5,000 apartments permitted at the time. By 2019, construction slowed down, with about 4,400 permits issued. When the pandemic was in full swing in 2020, Portland recorded its lowest number of apartment construction permits – about 1,200 of them. Construction rebounded in 2021 (2,550 permits), only to slow down again in 2022, with about 1,700 apartment permits.

Single-family construction yielded close to 7,500 homes in Portland.

For the 2013 to 2022 decade, Portland saw the addition of close to 7,500 single-family homes, based on building permits issued in this period. Most construction occurred in 2016 when Portland issued about 980 homes. 2018 came close to that construction level, with about 960 apartment units delivered, based on permits issued. Between 2013 and 2018, there was continuous growth in construction except for 2017, when construction slowed down slightly, but new construction still carried on, with about 860 single-family homes permitted. Beginning with 2019, construction went on a downward path – Portland issued about 700 permits for single-family homes, which came down to about 490 permits in 2022.

Self-storage construction in Portland stayed strong for the decade.

With single-family and multifamily construction carrying on through the decade, self-storage followed suit, as it usually accompanies the residential sector. Self-storage addresses the need for extra space that many people encounter when they move into their house or apartment. As such, Portland saw the addition of 2.4M square feet of self-storage space between 2013 and 2022. The first three years of the decade (2013 to 2015 included) saw no construction. However, beginning with 2016, the sector started building again with close to 40K of self-storage space added.

The most prolific year for construction was 2018, with over 700K square feet of self-storage added to the local inventory. Consequently, the following year saw new additions decrease by more than half, with about 240K square feet added in 2019. New deliveries picked up the pace in 2020 with over 620K square feet of self-storage. The decade ended on a more modest note, with 2022 seeing about 153K square feet of self-storage added to the local inventory.

Overall, the Portland market boasts a total of 4.6M square feet of self-storage, which comes down to about 4.3 square feet per person. Taking a cursory look at pricing, renting a Portland self storage unit costs $142/month for the standard non-climate-controlled 10’x10’ unit.

Office construction exceeded 5M square feet over a decade.

With Portland being a city where business thrives, the office sector is there to support its growth. As such, the city saw the addition of 5.8M square feet of office space from 2013 to 2022. The best-performing year of the decade was 2018, with 1.2M square feet of space constructed, prompting a slowdown in 2019 (363K square feet). 2016 achieved similar levels when the city delivered a little over 1M square feet for the office branch. When the pandemic rippled through in 2020 and 2021, office construction also felt its effects, as developers took a more cautious approach with the era of remote work stripping away the role of the traditional office. In response, Portland delivered 654K square feet in 2020 and 497K square feet in 2021. As it became evident that remote work and the hybrid model are here to stay, 2022 saw the addition of only 43K square feet of office space.

Construction ebbed and flowed throughout the decade, with 2014 being the sole year with no office construction recorded in Portland for the 2013 to 2022 decade.

Portland’s industrial development carried on from 2013 to 2022.

Not unlike other real estate sectors, the industrial front also thrived in Portland, with over 7.8M square feet of space delivered for the decade. Similar to the office sector, the peak of the decade was 2018, with 1.9M square feet of space constructed. Only 2015 came close to that record when nearly 1.8M square feet of industrial space came online. As a result, construction slowed down in 2019, with deliveries bringing in close to 388K square feet of industrial space, only a fraction of the 2018 construction.

In 2021, construction surpassed 1M square feet as it returned to the higher development levels recorded in previous years. Similar to the 2018 to 2019 period, in 2022, we see a marked reduction in new development — only 195K square feet constructed, a direct result of the high volume delivered in the previous year.